The emergence of Decentralized Finance (DeFi) has sparked excitement and debate in the financial world. DeFi refers to a suite of financial services built on blockchain technology, which aims to eliminate traditional intermediaries such as banks, brokers, and insurance companies. By leveraging smart contracts and decentralized networks, DeFi promises to democratize financial services, allowing anyone with an internet connection to access loans, insurance, trading, and more. However, while the potential benefits are vast, there are also significant risks that need to be addressed. In this blog, we’ll explore the DeFi movement, how it works, the opportunities it offers, and the challenges it faces.

What is DeFi?

DeFi is an umbrella term that encompasses a variety of financial services and applications, all built on blockchain technology, particularly Ethereum, which supports smart contracts—self-executing contracts with the terms of the agreement directly written into code. Unlike traditional financial services that rely on centralized institutions, DeFi platforms operate in a decentralized manner, meaning they are not controlled by any single entity.

- Key Components of DeFi:

- Smart Contracts: These are the backbone of DeFi applications. They automate processes like lending, borrowing, and trading, ensuring that transactions happen as specified without the need for a trusted third party.

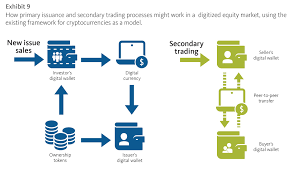

- Decentralized Exchanges (DEXs): These platforms allow users to trade cryptocurrencies directly with one another, without the need for centralized intermediaries like traditional exchanges (e.g., Coinbase or Binance).

- Stablecoins: These are cryptocurrencies pegged to a stable asset, such as the U.S. dollar, to reduce volatility and make DeFi applications more reliable for everyday use.

- Lending and Borrowing Protocols: DeFi platforms allow users to lend their crypto assets in exchange for interest, or borrow assets by collateralizing their holdings.

- Liquidity Pools: These are pools of funds provided by users that are used to facilitate trading on decentralized exchanges. In return, liquidity providers earn a portion of the transaction fees.

- The DeFi Ecosystem: The DeFi ecosystem is vast, with numerous projects, protocols, and platforms focused on specific aspects of finance. Some popular DeFi platforms include:

- Aave: A decentralized lending and borrowing platform.

- Uniswap: A decentralized exchange for trading Ethereum-based tokens.

- Compound: A platform that allows users to supply and borrow assets, earning interest on their holdings.

Opportunities in DeFi: The Promise of a Borderless Financial System

- Financial Inclusion: One of the most compelling benefits of DeFi is its ability to provide financial services to the unbanked and underbanked populations around the world. According to the World Bank, about 1.7 billion adults remain unbanked, often due to geographic or financial barriers. DeFi platforms, however, require only an internet connection, allowing anyone to access financial services, regardless of their location or socioeconomic status.

- Reduced Costs and Increased Efficiency: Traditional financial services are often burdened with high fees due to the involvement of intermediaries, such as banks, payment processors, and clearinghouses. DeFi platforms eliminate these intermediaries, significantly reducing costs and making transactions faster and more efficient.

- Greater Transparency and Security: DeFi platforms are built on blockchain technology, which provides a transparent and immutable ledger of all transactions. This transparency helps to reduce fraud and increase accountability. Additionally, the decentralized nature of DeFi platforms means that they are less vulnerable to single points of failure, such as bank bankruptcies or centralized exchange hacks.

- Yield Farming and Staking: DeFi also opens up new opportunities for earning passive income. Yield farming allows users to earn rewards by providing liquidity to decentralized protocols, while staking involves locking up cryptocurrency in a network to help secure it and earn rewards. These methods can offer significantly higher returns than traditional savings accounts or investment options.

Risks and Challenges: Is DeFi Too Good to Be True?

Despite its many benefits, DeFi also presents significant risks that cannot be ignored. As the space is still relatively new, regulatory uncertainty, security vulnerabilities, and market volatility pose serious challenges.

- Smart Contract Risks: Smart contracts, while revolutionary, are not immune to bugs or vulnerabilities. A single mistake in the code can lead to significant losses, as seen in several high-profile DeFi hacks. For example, in 2020, the DeFi platform bZx suffered two hacks that resulted in over $8 million in losses. As DeFi protocols rely on complex code, there is always the possibility of errors or malicious exploits that can result in the loss of funds.

- Regulatory Uncertainty: The regulatory landscape for DeFi is still unclear, and governments around the world are scrambling to figure out how to regulate this rapidly growing space. In many countries, DeFi projects operate in a grey area, with little clarity on whether they are subject to existing financial regulations. In the U.S., for example, regulators have been examining whether DeFi platforms should be classified as securities or whether they should comply with anti-money laundering (AML) and know-your-customer (KYC) requirements. Uncertainty around regulation could lead to legal challenges or even the shutdown of some DeFi platforms in the future.

- Impermanent Loss: Impermanent loss is a risk that liquidity providers face when the value of the assets they’ve contributed to a liquidity pool changes in relation to each other. If the value of one token in the pool increases or decreases significantly, the liquidity provider could end up with less value than if they had just held the assets in a wallet. While liquidity providers earn transaction fees as compensation, they may still suffer a loss if the price changes too drastically.

- Security Risks: The DeFi space has seen its share of hacks and vulnerabilities. As platforms are built on open-source code, they are often targeted by hackers looking to exploit weaknesses. The growing number of flash loan attacks, where attackers take out large loans to manipulate markets, has also raised concerns about the security of DeFi platforms. While blockchain technology itself is secure, the applications built on top of it are not foolproof, and as more capital flows into DeFi, the likelihood of attacks increases.

- Market Volatility: Cryptocurrencies are known for their volatility, and DeFi assets are no exception. While some DeFi tokens have experienced astronomical growth, they are also subject to significant price swings, which can result in substantial losses. In addition, the total value locked (TVL) in DeFi platforms can fluctuate, leading to sudden changes in the availability of liquidity and the overall stability of DeFi markets.

The Future of DeFi: A New Era of Finance?

Despite the risks, the DeFi ecosystem is rapidly growing and evolving, with new projects and innovations being launched regularly. Several factors point to a bright future for DeFi, including:

- Institutional Adoption: While DeFi initially attracted attention from retail investors, institutional players are now entering the space. Traditional financial institutions are beginning to explore how they can leverage DeFi to improve efficiency, reduce costs, and offer new financial products. This institutional interest could help legitimize DeFi and provide additional security and stability to the ecosystem.

- DeFi 2.0: The next generation of DeFi projects, known as DeFi 2.0, aims to address some of the limitations of current platforms, such as high gas fees and lack of scalability. Innovations like layer-2 solutions, which operate on top of Ethereum to reduce transaction costs, could make DeFi more accessible to a broader audience.

- Integration with Traditional Finance: Some experts believe that the future of DeFi lies in its integration with traditional financial systems. Hybrid models that combine the best of both worlds—decentralization and traditional regulation—could provide a balanced approach to financial services. For example, centralized exchanges and banks could work alongside DeFi platforms to offer secure, regulated, and efficient financial services.

A Double-Edged Sword

DeFi offers incredible potential to revolutionize the financial system by providing greater access, transparency, and efficiency. However, it also comes with significant risks, including security vulnerabilities, regulatory uncertainty, and market volatility. Whether DeFi will live up to its promise or turn out to be a passing trend depends on how well the industry addresses these challenges.

For now, DeFi remains a space to watch closely—offering both exciting opportunities and daunting risks. If the right solutions are found to mitigate the risks and establish clear regulations, DeFi could reshape the global financial landscape in profound ways.