Digital identity verification is a crucial aspect of modern life, from online banking and shopping to securing personal information on social media platforms. With the rise of digital services, ensuring that individuals can verify their identity online safely and efficiently has become a pressing concern. Traditional identity verification methods, like passwords, ID cards, and social security numbers, are increasingly being compromised, leading to a surge in identity theft and fraud. As the world moves further into the digital era, blockchain technology is being explored as a potential solution to address these challenges and provide a secure, decentralized way to manage digital identities.

This blog will explore how blockchain can revolutionize the way we manage and verify our identities online, the benefits and challenges of blockchain-based digital identity systems, and the future of digital identity verification.

The Current State of Digital Identity Verification

Currently, digital identity verification relies heavily on centralized systems managed by governments, banks, and other trusted institutions. These systems, such as identity cards, social security numbers, and biometric data, are often stored in centralized databases. However, these centralized systems have their drawbacks:

- Vulnerability to Hacking: Centralized databases are attractive targets for cybercriminals. Data breaches and hacking incidents have exposed the personal information of millions of individuals.

- Lack of Privacy: When personal data is stored in centralized databases, it can be accessed by various entities, sometimes without user consent. This raises privacy concerns, especially when individuals have little control over who accesses their information.

- Inefficiency: Traditional identity verification methods can be slow and cumbersome, requiring users to provide personal information repeatedly for each service they interact with.

As digital services continue to grow, the need for a more secure, efficient, and privacy-preserving method of verifying digital identities is evident. This is where blockchain comes into play.

What Is Blockchain and How Does It Work?

Blockchain is a decentralized, distributed ledger technology that allows data to be stored across a network of computers (called nodes). Unlike traditional centralized databases, where data is controlled by a single entity, blockchain relies on consensus mechanisms to validate and secure transactions, making it highly resistant to tampering and fraud.

Each transaction or piece of data on the blockchain is recorded in a “block,” and these blocks are linked together in a chronological chain, hence the name “blockchain.” Once a block is added to the chain, it is nearly impossible to alter, creating a secure and immutable record of all transactions.

The decentralized nature of blockchain means that no single entity has control over the data, giving individuals more ownership and control over their personal information. This feature makes blockchain an ideal solution for digital identity verification, where privacy, security, and trust are paramount.

How Blockchain Can Transform Digital Identity Verification

- Self-Sovereign Identity (SSI)

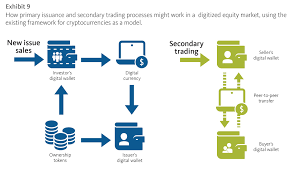

One of the most promising applications of blockchain in digital identity verification is the concept of Self-Sovereign Identity (SSI). SSI allows individuals to control their own identity without relying on a central authority. Instead of having personal data stored in a centralized database, individuals would store their identity information in a secure digital wallet on the blockchain. This could include data like names, addresses, and biometric information.

With SSI, users can selectively share their personal information with trusted parties, such as banks, healthcare providers, or government agencies, without the need to disclose sensitive information. For example, when accessing an online service, users could verify their identity by proving ownership of their blockchain-based identity without revealing their full name, date of birth, or other personal details.

The benefits of SSI include:

- Greater Control: Users have complete control over their personal data and can decide who has access to it.

- Enhanced Privacy: With SSI, individuals can share only the information that is necessary for a specific transaction, reducing the risk of exposing sensitive data.

- Reduced Identity Theft: Since personal data is stored on a decentralized blockchain and protected by encryption, the risk of data breaches and identity theft is significantly reduced.

- Decentralized Identity Verification

Blockchain enables decentralized identity verification, where identities are verified through distributed networks of trusted entities rather than a single central authority. These trusted entities, called verifiable credentials or trusted issuers, could be government agencies, educational institutions, or banks. For example, a university could issue a blockchain-based diploma as a verifiable credential that proves an individual’s educational background.

By using decentralized verification, the need for third-party intermediaries is eliminated, resulting in faster, cheaper, and more secure identity verification processes. Blockchain ensures that credentials are tamper-proof and easily accessible for verification, enhancing trust and reducing the risk of fraud.

- Improved Security and Fraud Prevention

Blockchain’s immutable nature ensures that once a piece of data is recorded on the blockchain, it cannot be altered or deleted without the consensus of the network. This provides a level of security that is difficult to achieve with traditional identity verification methods. In the context of digital identity, blockchain can help:

- Prevent Fraud: Since blockchain records are transparent and cannot be modified without consensus, fraudulent activities like identity theft or the creation of fake identities become much harder to execute.

- Enhance Authentication: Blockchain-based identities can incorporate multiple layers of authentication, such as biometric data, cryptographic keys, or multi-factor authentication, further securing the process.

- Streamlined KYC/AML Compliance

Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations are essential in the financial sector, requiring institutions to verify the identity of their customers and ensure they are not involved in illegal activities. Blockchain can simplify and streamline these compliance processes by allowing users to maintain a verified, tamper-proof digital identity.

Financial institutions and other regulated entities could access blockchain-based identities to verify their customers quickly and securely, reducing the need for repetitive KYC checks. Since the identity information is stored on a decentralized ledger, it is always up to date and can be shared instantly, making the process more efficient and less costly.

Challenges and Limitations of Blockchain-Based Digital Identity

While blockchain offers many benefits for digital identity verification, there are several challenges that need to be addressed:

- Scalability: Blockchain networks can become congested when there are large numbers of users or transactions. This could slow down the process of verifying identities, especially in high-volume industries like banking and e-commerce.

- Adoption and Interoperability: For blockchain-based digital identity systems to be successful, they need to be widely adopted across industries and countries. There must be interoperability between different blockchain platforms and traditional systems to ensure seamless integration.

- Legal and Regulatory Framework: The legal status of blockchain-based identities is still unclear in many jurisdictions. Governments and regulators will need to develop new laws and regulations to govern the use of blockchain for identity verification, especially in cases where identity fraud or data breaches occur.

- User Education and Trust: Many individuals are unfamiliar with blockchain technology and may be hesitant to adopt blockchain-based digital identities. Educating users on the benefits and security features of blockchain identities will be crucial to gaining widespread adoption.

The Future of Blockchain and Digital Identity

The future of digital identity verification is likely to be shaped by the adoption of blockchain technology. As blockchain-based solutions mature and gain traction, we can expect the following developments:

- Wider Adoption of SSI: Self-sovereign identity systems will become more common, allowing individuals to control their own identity data across various online services.

- Integration with IoT and Biometrics: Blockchain-based digital identities may be integrated with other technologies, such as the Internet of Things (IoT) and biometric authentication, to create even more secure and seamless verification systems.

- Government Support: Governments may adopt blockchain-based identity systems to improve the efficiency and security of public services, such as voting, social welfare programs, and passport issuance.

Blockchain has the potential to revolutionize digital identity verification by offering secure, private, and efficient solutions to address the shortcomings of traditional methods. With the rise of self-sovereign identity systems and decentralized verification, individuals will have greater control over their personal data, reducing the risk of identity theft and fraud. However, challenges like scalability, adoption, and regulatory frameworks must be addressed before blockchain can fully transform the identity verification landscape.

As blockchain technology continues to evolve, the future of digital identity is likely to be more decentralized, secure, and user-centric. By leveraging blockchain’s transparency, immutability, and security, we can create a more trustworthy and efficient system for verifying identities in the digital world.