Blockchain technology, the foundation of cryptocurrencies like Bitcoin and Ethereum, is often hailed as a disruptive force capable of transforming various industries. While its most prominent application has been in the world of digital currency, blockchain’s potential extends far beyond just crypto. The technology promises to revolutionize traditional financial systems by offering decentralized, transparent, and secure solutions to age-old problems like fraud, inefficiency, and high transaction costs. In this blog, we’ll explore how blockchain is reshaping the financial sector, the key benefits it offers, and the challenges it faces in mainstream adoption.

What is Blockchain Technology?

At its core, blockchain is a distributed ledger technology (DLT) that records transactions in a secure and transparent manner across a network of computers. Unlike traditional centralized databases, where data is controlled by a single entity (such as a bank or a government), blockchain operates on a decentralized network, making it resistant to tampering and fraud.

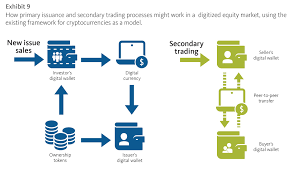

Each block in the blockchain contains a list of transactions, a timestamp, and a reference to the previous block, forming a chain. This structure ensures the integrity and immutability of the data. Blockchain’s decentralized nature allows for peer-to-peer transactions, reducing the need for intermediaries and improving transparency.

Blockchain’s Impact on Traditional Banking Systems

The financial industry has long been dominated by centralized institutions, such as banks and payment processors, which control and verify transactions. While this system has served its purpose for centuries, it is not without its drawbacks. Traditional banking can be slow, expensive, and prone to errors or fraud, especially when it comes to cross-border transactions. Blockchain technology has the potential to address many of these challenges.

- Faster Transactions

- One of the most significant benefits of blockchain is its ability to process transactions faster than traditional banking systems. For example, international money transfers can take several days to complete through conventional channels like SWIFT or PayPal. In contrast, blockchain-based systems can complete these transactions within minutes or even seconds, reducing delays and improving cash flow for businesses and individuals.

- Lower Transaction Costs

- Blockchain eliminates the need for intermediaries, such as banks, payment processors, or clearinghouses, which often charge fees for processing transactions. By removing these middlemen, blockchain can significantly reduce the costs associated with financial transactions, making it more affordable for businesses and consumers.

- Enhanced Security and Fraud Prevention

- Security is a top concern in the financial sector, especially when it comes to protecting sensitive data. Blockchain offers enhanced security features, such as cryptographic encryption and consensus algorithms, which make it extremely difficult to alter or tamper with transaction data. This level of security makes blockchain an attractive solution for reducing fraud and increasing trust in financial transactions.

- Transparency and Immutability

- Transparency is another key advantage of blockchain technology. Every transaction recorded on a blockchain is visible to all participants in the network, creating a transparent system where no single entity has full control over the data. Additionally, once a transaction is recorded, it cannot be altered or deleted, ensuring the integrity of the data and preventing fraud or corruption.

Blockchain and Decentralized Finance (DeFi)

One of the most exciting developments in the blockchain space is the rise of decentralized finance (DeFi), a system of financial services built on blockchain that operates without traditional intermediaries. DeFi platforms leverage smart contracts—self-executing contracts with the terms of the agreement written into code—to offer a wide range of financial services, including lending, borrowing, trading, and insurance.

In the DeFi ecosystem, users can access financial products directly, without relying on banks or other intermediaries. This creates a more inclusive financial system, where anyone with an internet connection can participate, regardless of their location or financial status. DeFi has the potential to democratize access to financial services, making it easier for individuals in underserved or unbanked regions to access credit, savings, and investment opportunities.

Blockchain in Cross-Border Payments

Cross-border payments have long been an area where traditional financial systems have faced significant inefficiencies. Sending money across borders typically involves high fees, long wait times, and multiple intermediaries. Blockchain-based systems can solve many of these problems by providing a faster, cheaper, and more transparent alternative.

For instance, Ripple’s XRP is a cryptocurrency designed to facilitate fast and low-cost cross-border payments. Ripple’s blockchain network enables real-time settlement of international transactions, reducing the need for intermediaries and significantly cutting down on fees. Banks and financial institutions have started adopting Ripple’s technology to improve their cross-border payment services, highlighting the growing importance of blockchain in global finance.

Additionally, blockchain can make remittances more affordable for individuals sending money to family members abroad. By eliminating the need for intermediaries and reducing transaction costs, blockchain can lower the fees associated with remittances, providing financial relief to millions of people around the world.

The Rise of Central Bank Digital Currencies (CBDCs)

As blockchain technology gains traction, governments around the world are exploring the possibility of creating their own digital currencies. Central Bank Digital Currencies (CBDCs) are digital currencies issued and regulated by a country’s central bank. Unlike cryptocurrencies like Bitcoin, which are decentralized and not controlled by any single authority, CBDCs are fully regulated and backed by the government.

CBDCs have the potential to modernize traditional financial systems by making digital currencies more accessible and efficient. They could provide a faster and more secure alternative to physical cash, while also reducing the costs associated with printing and distributing money. Additionally, CBDCs could offer greater transparency in monetary policy, as transactions would be recorded on a blockchain and subject to regulatory oversight.

Several countries, including China, Sweden, and the European Union, are actively researching and developing CBDCs, with some already conducting pilot programs. The rise of CBDCs could lead to greater integration of blockchain technology within traditional financial systems, further bridging the gap between digital currencies and conventional banking.

Challenges of Implementing Blockchain in Finance

Despite its potential, there are several challenges to the widespread adoption of blockchain in traditional finance. Some of these challenges include:

- Scalability

- One of the main issues with blockchain technology is scalability. As more users join a blockchain network, the system can become slower and less efficient, especially when it comes to processing a high volume of transactions. While solutions like the Lightning Network (for Bitcoin) and Ethereum 2.0 aim to address scalability, this remains a significant barrier to widespread adoption.

- Regulatory Uncertainty

- The regulatory landscape for blockchain and cryptocurrencies is still evolving, and many financial institutions are hesitant to adopt blockchain-based systems due to concerns about compliance. Governments and regulators are still grappling with how to classify and regulate digital currencies, and a lack of clear guidelines could slow down blockchain adoption in the financial sector.

- Integration with Legacy Systems

- Traditional financial institutions rely on complex, legacy systems that may not be compatible with blockchain technology. Integrating blockchain into these existing systems can be costly and time-consuming, and some institutions may resist the change due to the disruption it could cause.

- Security Concerns

- While blockchain is inherently secure, vulnerabilities still exist, particularly in smart contracts and the way decentralized applications (dApps) are coded. Security breaches or bugs in smart contracts could lead to financial losses or other issues, making it important for developers and institutions to implement robust security measures.

The Future of Blockchain in Financial Systems

Blockchain technology is poised to revolutionize the financial sector by offering faster, cheaper, and more secure solutions to many of the challenges that traditional systems face. From improving cross-border payments and enabling decentralized finance to potentially ushering in a new era of digital currencies, blockchain has the power to transform the way we think about money and financial services.

As blockchain adoption continues to grow, we are likely to see an increasing number of financial institutions, governments, and businesses integrating the technology into their operations. While there are still challenges to overcome, the potential benefits of blockchain in the financial world are undeniable, and it’s clear that the technology will play a major role in the future of finance.