Cryptocurrency, once a fringe concept, has now become a global financial force, transforming how we think about money, investments, and even governance. As more people adopt digital assets like Bitcoin and Ethereum, the demand for clear and cohesive regulation grows. The regulatory landscape for cryptocurrency is still evolving, with governments and institutions worldwide working to determine how to handle digital assets, protect consumers, and ensure financial stability. This blog will explore the current state of crypto regulation, the challenges regulators face, and what the future may hold for the legal framework surrounding digital currencies.

The Global Push for Crypto Regulation

In the past decade, the rise of cryptocurrencies has largely occurred in a regulatory gray area, with many countries not having specific laws or frameworks to govern the use and trading of digital currencies. This has led to concerns over issues like consumer protection, money laundering, tax evasion, and market manipulation.

However, the increasing integration of cryptocurrencies into the mainstream financial system has prompted governments to take action. Regulatory bodies across the world are scrambling to put frameworks in place to manage the growing crypto ecosystem. Some regions, such as the European Union and the United States, are taking a more proactive approach to crypto regulation, while others are still figuring out how to address the challenges posed by these decentralized technologies.

Major Regulatory Developments

- United States: The SEC and CFTC Involvement

In the United States, cryptocurrency regulation is primarily overseen by two government agencies: the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). The SEC has focused on determining whether specific cryptocurrencies should be classified as securities, which would subject them to securities laws. For example, Bitcoin and Ethereum are often considered commodities, while other tokens may be classified as securities.

The SEC has also cracked down on Initial Coin Offerings (ICOs) that it considers unregistered securities offerings, leading to several high-profile legal battles. The CFTC, on the other hand, regulates crypto derivatives and futures markets, and the agency has expressed a desire to support innovation while ensuring that these markets are stable and secure.

- European Union: The MiCA Regulation

The Markets in Crypto-Assets (MiCA) regulation, proposed by the European Commission, represents one of the most comprehensive efforts to regulate cryptocurrency in the EU. MiCA aims to provide legal clarity on crypto assets and protect consumers from potential risks while promoting innovation in the blockchain space.

Some key aspects of MiCA include:

- Clear definitions of crypto assets, stablecoins, and utility tokens.

- Requirements for crypto service providers to register and comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

- Regulatory oversight of stablecoin issuers to ensure their stability and security.

If passed, MiCA could become a model for other countries and regions looking to regulate the crypto industry.

- China: A Hardline Stance

While many countries have taken a wait-and-see approach, China has taken a more aggressive stance by cracking down on cryptocurrency activities. In 2021, China banned cryptocurrency mining and prohibited financial institutions from providing services related to crypto transactions. This move was part of China’s broader effort to develop its own digital currency, the Digital Yuan (e-CNY), which it views as a more controlled and stable alternative to decentralized cryptocurrencies.

China’s actions have caused significant shifts in the global crypto market, with mining operations moving to countries with more favorable regulations, such as the United States, Kazakhstan, and Canada. Despite this, the Chinese government remains adamant about limiting the influence of decentralized cryptocurrencies.

- El Salvador: Leading the Way with Bitcoin Legal Tender

El Salvador has made headlines by becoming the first country in the world to officially adopt Bitcoin as legal tender. In 2021, the country passed a law that allows Bitcoin to be used as an official currency alongside the U.S. dollar. This bold move has sparked global debate about the potential benefits and risks of making a decentralized cryptocurrency a national currency.

El Salvador’s experiment with Bitcoin has raised several key questions:

- Volatility Risk: Bitcoin’s extreme price volatility could pose challenges for everyday transactions and economic stability.

- Financial Inclusion: Bitcoin could offer financial services to the unbanked population of El Salvador, enabling access to banking and international remittances.

- International Relations: The decision has sparked controversy, with the International Monetary Fund (IMF) and World Bank expressing concerns over the country’s adoption of Bitcoin.

The outcome of El Salvador’s experiment could influence other countries’ decisions to embrace or reject cryptocurrencies as legal tender.

Challenges in Regulating Crypto

Despite the efforts being made to regulate the crypto space, there are several challenges that regulators face:

- Decentralization and Lack of Control

One of the key features of cryptocurrencies is their decentralization. Cryptocurrencies like Bitcoin are not controlled by any central authority, which makes them difficult to regulate. This poses a challenge for regulators who are used to having control over traditional financial systems.

Additionally, many crypto projects are built on decentralized platforms that operate across borders, making it difficult for governments to enforce regulations. This creates a complex legal environment where jurisdictional issues come into play.

- Anonymity and Privacy Concerns

Many cryptocurrencies, especially privacy-focused coins like Monero and Zcash, allow users to transact anonymously. While this provides privacy benefits, it also creates concerns about illegal activities like money laundering, tax evasion, and the financing of terrorism. Regulators must find a balance between protecting user privacy and preventing illicit activities.

- Rapid Technological Advancements

The fast-paced nature of blockchain innovation presents a challenge for regulators, who struggle to keep up with new developments. Decentralized finance (DeFi), for example, has created an entirely new financial ecosystem that is difficult to regulate using traditional methods. Similarly, the rise of Non-Fungible Tokens (NFTs) and smart contracts has introduced new questions about ownership, intellectual property, and legal accountability.

- Global Coordination

Cryptocurrency is a global phenomenon, and many crypto transactions occur across borders. This creates challenges for regulators who must coordinate their efforts with other countries to prevent regulatory arbitrage, where crypto activities are moved to jurisdictions with looser regulations. International cooperation will be crucial to creating a cohesive regulatory framework for cryptocurrencies.

The Future of Crypto Regulation

As the cryptocurrency industry continues to mature, the regulatory landscape will likely evolve as well. Here are some key trends to watch for in the future:

- Stronger Consumer Protection Laws

As cryptocurrencies become more mainstream, regulators are likely to focus on consumer protection. This could include measures to prevent fraud, hacking, and scams, as well as ensuring that investors are provided with clear information about the risks of investing in digital assets.

- Taxation of Crypto Gains

Governments worldwide are increasingly looking for ways to tax cryptocurrency transactions, capital gains, and income. Clearer tax guidelines and reporting requirements could provide more transparency in the crypto market and help integrate digital assets into the broader financial system.

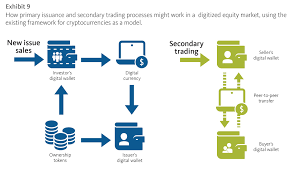

- Central Bank Digital Currencies (CBDCs)

Governments are likely to continue exploring the concept of Central Bank Digital Currencies (CBDCs). These state-backed digital currencies could complement or even compete with decentralized cryptocurrencies. The introduction of CBDCs could lead to more comprehensive regulation of the crypto space, as governments seek to manage digital currency ecosystems more closely.

- Increased Regulatory Clarity

As more countries develop comprehensive crypto regulations, we can expect greater legal clarity in the crypto industry. This could lead to more widespread adoption of digital assets by institutional investors, businesses, and consumers, as well as greater trust in the security and legitimacy of cryptocurrency networks.

Cryptocurrency regulation is a rapidly evolving and complex issue that requires a careful balance between fostering innovation and protecting consumers. While some countries have moved forward with more aggressive regulatory frameworks, others are still figuring out how to approach this new asset class. As the global crypto market continues to grow, we can expect more clarity, more regulation, and more cooperation between governments to address the challenges and opportunities presented by digital assets.

The future of crypto regulation will likely involve stronger consumer protection laws, better tax frameworks, the rise of CBDCs, and greater global coordination. As the legal landscape becomes clearer, cryptocurrency could become a more integrated part of the global financial system, offering new opportunities for investment, innovation, and financial inclusion.